Explore the world of mobile phones, from the latest iPhone releases to Android innovations. Stay connected with reviews, tips, and updates.

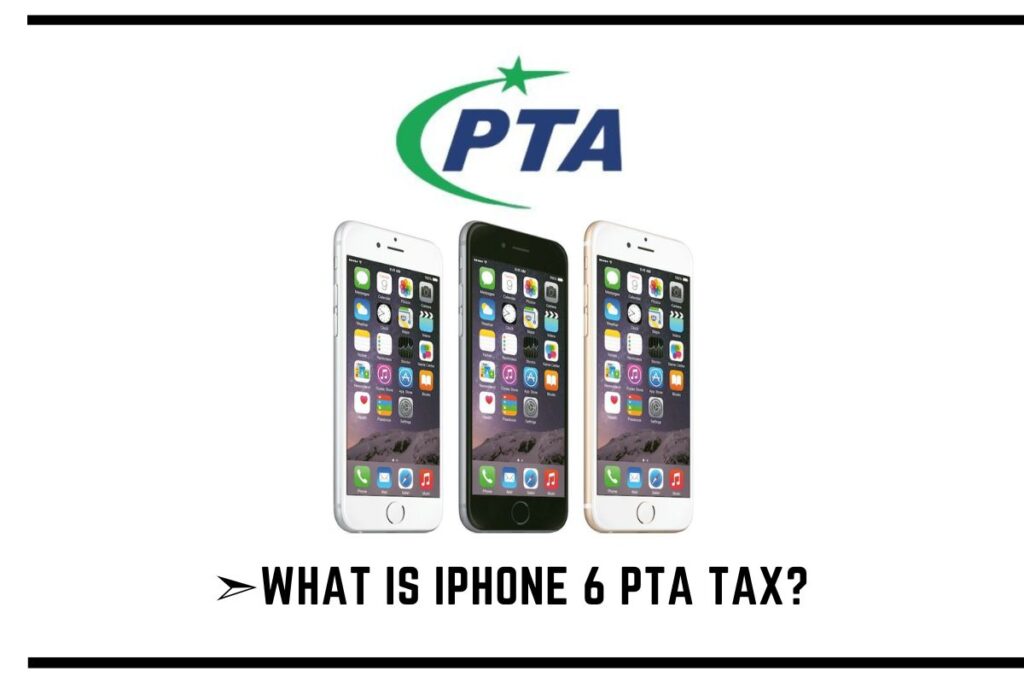

In this era of technological marvels, smartphones have become an essential part of our lives. If you’re planning to buy an iPhone 6 in Pakistan, you might have heard about the PTA tax.

What is this tax, and how much does it affect the overall cost of owning an iPhone 6? This article will provide you with a complete understanding of the iPhone 6 PTA tax, ensuring that you make an informed decision.

How Much is the iPhone 6 PTA Tax?

Are you wondering about the specific details of iPhone 6 PTA tax? Look no further; we’ve got you covered. Here’s a detailed breakdown of the tax:

| Heading | Description |

| What is PTA Tax? | Understanding the purpose of PTA tax. |

| Tax Rate for iPhone 6 | Explaining the tax rate for iPhone 6. |

| Calculating Tax | Step-by-step guide to calculate the tax. |

| Payment Process | How to pay the PTA tax for your iPhone 6. |

| Exemptions | Discovering who is exempt from this tax. |

| Penalties for Non-Payment | Consequences of not paying the tax. |

| Impact on iPhone 6 Price | How the tax affects the iPhone 6 price. |

| Comparative Analysis | Comparing iPhone 6 tax with other models. |

| PTA and Mobile Registration | Understanding the connection. |

| Popular Myths | Busting common myths about iPhone 6 tax. |

| Tips to Save on Tax | Strategies to reduce your tax burden. |

| Future Changes | Possible developments in the tax structure. |

| Legal Implications | The legal aspects of PTA tax evasion. |

| Government Initiatives | Government measures to streamline tax. |

| Recent Updates | Stay updated on the latest changes. |

| Frequently Asked Questions (FAQs) | Common queries about iPhone 6 PTA tax. |

What is PTA Tax?

PTA (Pakistan Telecommunication Authority) tax is imposed on mobile devices to regulate their usage within Pakistan. The tax is essential for ensuring that all mobile devices in the country are legitimate and not stolen or smuggled. This helps in maintaining law and order and curbing illegal activities.

Tax Rate for iPhone 6

For iPhone 6, the PTA tax rate is determined based on its current market value. As of the latest update, the tax rate for iPhone 6 is 10% of the device’s assessed value. This value can vary, so it’s crucial to stay updated with the latest assessments to determine the exact tax amount.

Calculating Tax

Calculating the PTA tax for your iPhone 6 is relatively straightforward. You can use the following formula:

Tax Amount = iPhone 6 Market Value * Tax Rate (10%)

Make sure to check the latest market value and tax rate to ensure accurate calculations.

Payment Process

Paying the PTA tax for your iPhone 6 is a simple process. You can pay it online or visit a designated payment center. Keep your device’s IMEI number handy, as it will be required during the payment process.

Exemptions

Not everyone is subject to PTA tax. If you are a foreigner visiting Pakistan temporarily, you may be exempt from this tax. However, it’s essential to familiarize yourself with the eligibility criteria for exemptions.

Penalties for Non-Payment

Avoiding the PTA tax is not advisable, as it can lead to severe consequences. Non-payment can result in your device being blocked or confiscated, and you may face legal action.

Impact on iPhone 6 Price

The PTA tax can significantly impact the overall cost of owning an iPhone 6 in Pakistan. It’s crucial to consider this when budgeting for your purchase.

Comparative Analysis

To understand how iPhone 6 PTA tax stacks up against other iPhone models, let’s take a quick look at the tax rates for a few popular models:

| iPhone Model | Tax Rate (%) |

| iPhone 6 | 10% |

| iPhone 7 | 15% |

| iPhone 8 | 20% |

| iPhone 12 Pro | 30% |

PTA and Mobile Registration

PTA tax is closely linked to mobile device registration. Ensure your iPhone 6 is properly registered with PTA to avoid any issues in the future.

Popular Myths

Several myths and misconceptions surround iPhone 6 PTA tax. Let’s debunk a few of them:

- Myth 1: “The tax rate is fixed at 10%.”

- Myth 2: “Foreign tourists are always exempt.”

- Myth 3: “You can evade the tax easily.”

Tips to Save on Tax

If you want to reduce your tax burden, consider these tips:

- Purchase during tax amnesty periods.

- Explore used or refurbished iPhone 6 options.

- Stay informed about tax rate updates.

Future Changes

The government can introduce changes to the PTA tax structure. Stay updated with the latest news to ensure compliance.

Legal Implications

Avoiding PTA tax is illegal and can lead to legal troubles. Always pay your dues to stay on the right side of the law.

Government Initiatives

The government periodically introduces initiatives to streamline the tax process, making it more convenient for users.

Recent Updates

Stay informed about the latest updates regarding iPhone 6 PTA tax to ensure compliance with the law.

Conclusion

In conclusion, understanding the iPhone 6 PTA tax is essential if you plan to purchase this device in Pakistan. It’s vital to stay informed about the tax rate, calculation process, and payment procedures to ensure a hassle-free experience. Always comply with the law to avoid any penalties. If you found this article helpful, please hit the like button and share it with others.

Frequently Asked Questions (FAQs)

Is the Iphone 6 PTA tax applicable to both new and used devices?

Yes, the Iphone 6 PTA tax applies to both new and used devices. Whether you’re bringing a brand-new Iphone 6 or a second-hand one, you’ll need to pay the applicable tax.

Can I get an exemption for my Iphone 6 if I’m an overseas Pakistani?

Yes, if you are an overseas Pakistani returning to Pakistan, you may be eligible for exemptions or discounts on the Iphone 6 PTA tax. Make sure to check the PTA’s official guidelines to determine your eligibility.

What happens if I don’t pay the Iphone 6 PTA tax?

If you fail to pay the Iphone 6 PTA tax, your device may be confiscated, and you could face legal consequences, including fines and penalties. It’s essential to comply with the tax regulations to avoid any issues.

How can I calculate the exact Iphone 6 PTA tax for my device?

To calculate the precise Iphone 6 PTA tax for your device, you can visit the PTA’s official website or consult with a customs official. They will guide you through the process and help you determine the accurate tax amount.

Are there any specific documents I need for paying the Iphone 6 PTA tax?

Yes, you’ll need to provide relevant documents, including proof of ownership, a copy of your CNIC or passport, and the device’s IMEI number, when paying the Iphone 6 PTA tax.

Can I pay the Iphone 6 PTA tax online?

Yes, you can pay the Iphone 6 PTA tax through various online methods, such as mobile wallets or bank transfers. Ensure you keep the payment receipts as they will be required for customs clearance.